COP26: UK Firms Will Have To Show How They Will Hit Net Zero

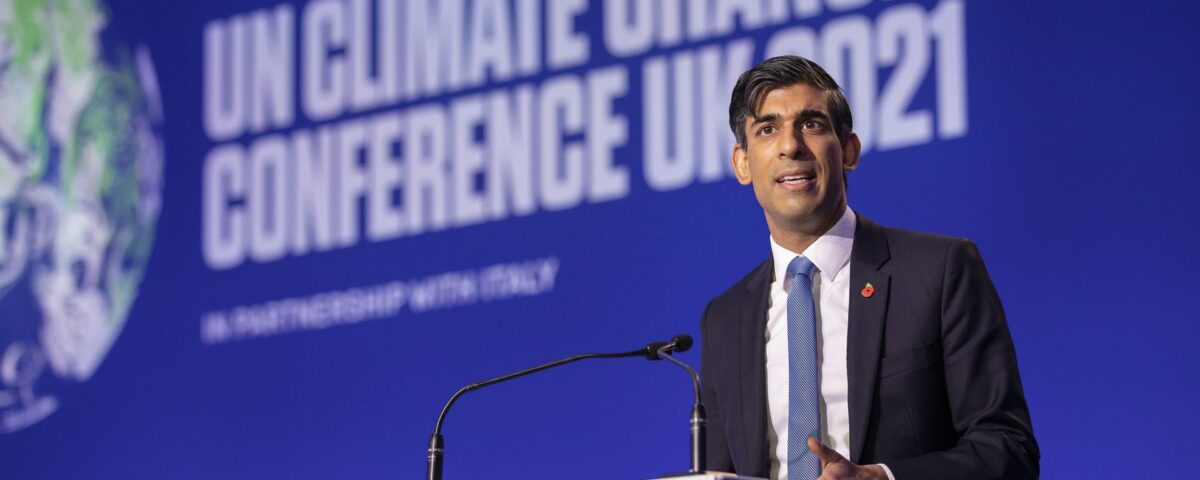

COP26: Glasgow’s UN Climate Conference Opens With Key Speeches

01/11/2021

Scheme To Replace EU Cash For Poor Areas Unveiled

03/11/2021COP26: UK Firms Will Have To Show How They Will Hit Net Zero

Most big UK firms and financial institutions will be forced to show how they intend to hit climate change targets, under proposed Treasury rules.

By 2023, they will have to set out detailed public plans for how they will move to a low-carbon future – in line with the UK’s 2050 net-zero target.

An expert panel will set the standards the plans need to meet to ensure they are not just spin.

Net-zero is when a business or a country achieves an overall balance between the amount of carbon it is emitting and the carbon that it’s removing from the atmosphere.

Firms and their shareholders will be left to decide how their businesses adapt to this transition, including how they intend to decarbonise.

And although the plans will need to be published, the UK government said “the aim is to increase transparency and accountability” and the UK was not “making firm-level net-zero commitments mandatory”.

Under the proposed Treasury rules, financial institutions and companies with shares listed on the London Stock Exchange must come up with net-zero transition plans, which will be published from 2023.

The strategies will need to include targets to reduce greenhouse gas emissions, and steps that firms intend to take to get there.

A task force made up of industry leaders, academics, regulators and civil society groups will set a science-based “gold standard” for the plans in order to guard against so-called “greenwashing” – where environmental initiatives are more about marketing than substance.