UK Recession Risk Grows As Higher Interest Rates Weigh On Firms

Rishi Sunak Pushes New Petrol And Diesel Car Ban Back To 2035 In Major U-Turn

21/09/2023

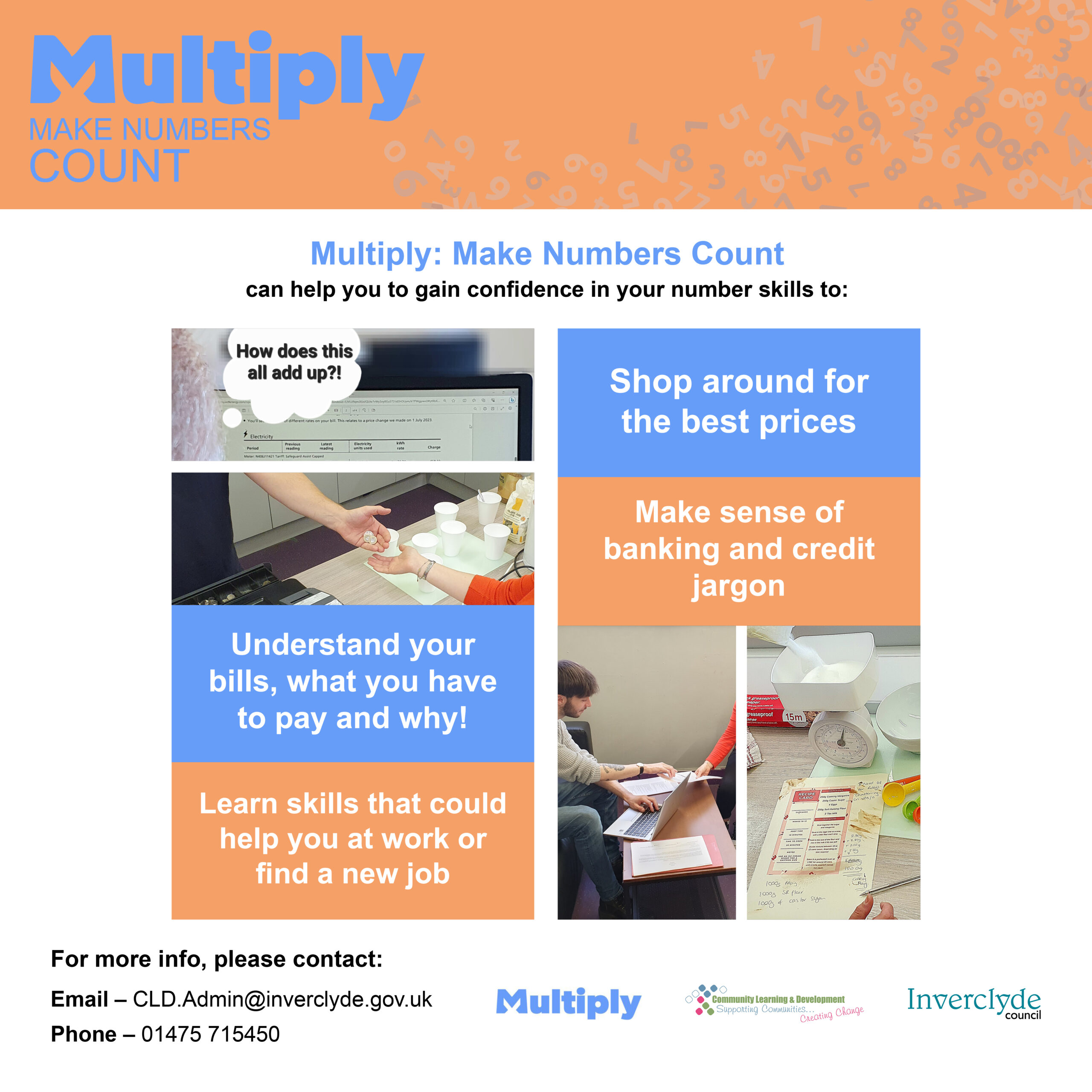

Residents Can Access Support To Make Sure Life Adds Up

26/09/2023UK Recession Risk Grows As Higher Interest Rates Weigh On Firms

Britain’s economy is at growing risk of recession, with industry figures showing the sharpest monthly fall in private sector activity, outside of the Covid pandemic, since the financial crisis.

In a sign that higher interest rates and the cost of living crisis are combining to depress consumer demand, the latest snapshot from S&P Global and the Chartered Institute of Procurement and Supply (Cips) showed a steep drop in the UK’s dominant service sector and manufacturing output in September.

Aside from pandemic disruptions to the economy, the latest decrease in the purchasing managers’ index (PMI) was the steepest since March 2009.

On Thursday, the Bank of England halted its most aggressive round of interest rate increases in decades on Thursday amid growing concerns over the economy, holding borrowing costs at 5.25% after 14 previous rises.

Total new work in the private sector fell for the third month in a row, with firms warning that cost of living pressures and higher borrowing costs, alongside cutbacks in the real estate and construction sectors, were weighing on activity.

The S&P Global/Cips UK PMI composite output index fell from 48.6 in August to 46.8 in September. A reading above 50 separates growth from contraction.

Chris Williamson, the chief business economist at S&P Global Market Intelligence, said the reading was consistent with the economy shrinking at a quarterly rate of about 0.4%. Two consecutive quarters of decline are regarded as the technical definition of a recession.

Williamson said: “The disappointing PMI survey results for September mean a recession is looking increasingly likely in the UK. Underscoring the severity of the UK’s deteriorating situation, September’s downturn is the steepest since the height of the global financial crisis in early 2009, barring only the pandemic lockdown months.”