GOV.UK Covid-19 Business Support Finder Tool Launched

22/04/2020First Minister Unveils Framework for Looking Beyond Lockdown

23/04/2020

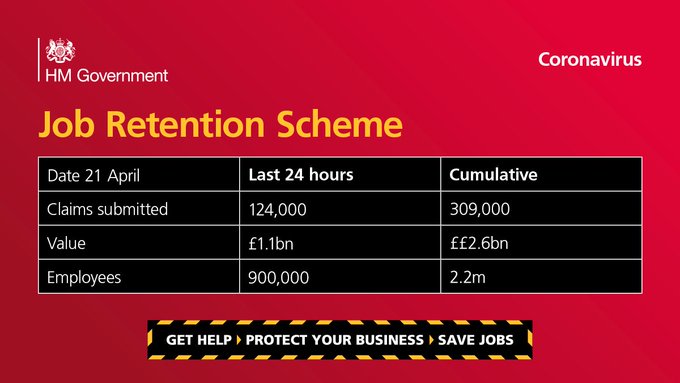

The Government’s Coronavirus Job Retention Scheme which launched on Monday (20th April) to allow businesses able to claim up to £2,500 a month towards staff wages, has already received applications from 309,000 firms so far.

Since the scheme launched it has seen:

-

309,000 firms submitted claims

-

2.2m employees reported as furloughed so far

-

Claims with a total value of £2.6bn

Employers can apply for direct cash grants for furloughed staff now through HMRC’s new online portal here – with the money expected to land in their bank accounts within six working days.

The job retention scheme, announced by Chancellor Rishi Sunak as part of a package of support to protect jobs and businesses, allows employers to claim for a cash grant of up to 80% of a furloughed employees wages, capped at £2,500 a month.

Millions of people across the UK are expected to benefit from the scheme, with businesses including Pret a Manger, Brewdog and Timpsons using it to ensure staff keep their jobs and are paid whilst many high street businesses are closed.

HMRC’s portal has a step by step application process and up to 5,000 staff will be manning phone lines and webchat services to ensure any questions can be answered. To download the step by step guide to the Job Retention Scheme, click here.

Last week the Chancellor announced the scheme will be extended for a further month until the end of June, to reflect continuing Covid-19 lockdown measures.

Employers can furlough anyone they employ, provided that on or before March 19 they were on PAYE payroll and HMRC has been notified of payment via the RTI system.

Please note the following key guidelines:

-

To receive payment by 30 April businesses will need to complete an application by 22 April. This is because it will take six working days for the claim to be processed, issued and received.

-

Businesses will need to decide whether they want to make their own claim or if they want their agent to act on their behalf – if they have an agent that has authorisation to act for them on PAYE matters, they can make a claim for CJRS on their behalf.

-

Only call HMRC if you can’t find what you need on gov.uk. All applications will be processed online. After a claim has been submitted it will take six working days for it to be paid – please do not chase up payment during this time.

-

Employees should speak to their employers with any questions, not HMRC. They won’t be able to answer queries from individual employees.